Why Bookkeeping Is Critical for Business Growth (Even for Startups)

This guide explains why bookkeeping is critical for business growth. You’ll learn the real importance of bookkeeping beyond just tax season, how it drives smarter decisions, strengthens cash flow, builds investor trust, and sets the foundation for sustainable expansion. From understanding your numbers to knowing when to hand off your books to professionals, this is the complete, practical roadmap every business owner needs to know.

Let’s Get One Thing Straight About Business Growth

Bookkeeping isn’t why you started your business. You started to build something bigger. Your job isn’t to chase receipts or balance spreadsheets at 10 p.m. But here’s the catch: if you don’t do it, it costs you cash.

So, you can’t ignore bookkeeping. You should know where your money goes, what’s profitable, and what’s bleeding cash. That’s how you lead with confidence.

But as your business grows, the time you spend managing books starts costing you more than it saves. At that point, the smartest move is to get it off to people who live and breathe this stuff.

That’s what we do at FINITAC, we keep your books clean so your focus stays clear and on what actually drives growth. You can book a free consultation call with our experts, and they will explain to you, step by step, how they can transform your business.

Why Bookkeeping Is Critical for Business Growth (Even for Startups)

When people talk about business growth, they talk about everything from marketing, sales, and their overall investment, but they often skip bookkeeping. Yet, no business has ever succeeded and scaled without organized books.

Startups that ignore it often end up realizing too late that they’re spending more than they’re earning. With proper bookkeeping, you can avoid that. This guide includes everything you need to know to understand the importance of bookkeeping. So, without any further ado. Let’s dig in!

Hire A Professional Accountant From FINITAC

FINITAC offers highly professional and certified accountants with a modular services model. Let us know your requirements, and you’ll be connected with the right team.

Why Bookkeeping Matters for Every Business

Every business owner wants to make high profits, but does he actually find out his true returns? You track all your expenses and sales. Organize and calculate that data to figure out your real profit margins and your monthly expenses.

This data opens up a clear picture of all your spending. Thus, you make financial decisions based on facts. Moreover, you’re ready for tax season or audits at any time.

Accurate books also make you funding-ready because investors and lenders will always request financial statements before writing a check.

The Business Growth Formula Hidden in Your Books

Revenue – Expenses = Profit is obvious. But growth depends on what you do next with that profit, and that decision requires reliable bookkeeping.

When your books are updated weekly, you can identify high-margin products or clients. You can also predict cash shortages before they happen. You also spot slow-paying customers early and fix cash flow gaps.

Without organized books, these insights are impossible. You’re basically running on instinct, and instinct doesn’t help you scale quickly.

Bookkeeping Works As a Decision-Making Tool

The importance of bookkeeping goes beyond compliance. It’s the foundation of your business decisions.

Imagine you’re a startup owner in Texas selling handmade furniture. You made $50k last, but without bookkeeping, you might not realize $20k went to materials, $15k to logistics, and $10k to ads. Your profit is only $5k

On the other hand, when your books are organized and accurate, you get real-time information on where your money is going. You can re-price your products on time, cut wasteful expenses, and justify your spending with one goal: to maximize your profits.

People Also Search For

Here’s How Poor Bookkeeping Limits Your Growth

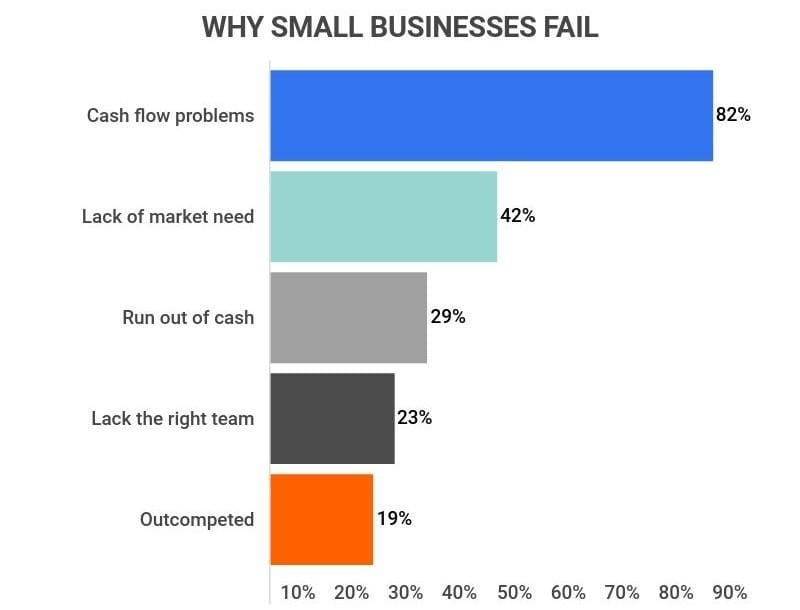

It is important to understand the profit and loss and the cash flow projections. Bad bookkeeping quietly destroys businesses. If you’re not tracking everything, you end up mixing personal and business finances. You don’t track recurring expenses.

These mistakes lead to wrong financial decisions. You might think you can afford to hire or invest, but you’re running cost to cost in real.

That’s why many founders choose professional help early. A clean set of books can literally double your growth potential, as every dollar is tracked and reused strategically.

How Professional Bookkeeping Accelerates Growth

Here’s what changes once you stop doing it yourself and bring in experts like FINITAC:

| Before Professional Help | After Professional Bookkeeping (with FINITAC) |

| Spending hours every week fixing errors | Books are automatically updated and categorized |

| Unclear profit margins | Real-time dashboards showing performance |

| Missing tax deductions | Every deductible expense is tracked |

| Cash flow surprises | Forecasts and reminders prevent shortfalls |

| Guessing growth strategy | Data-driven plans for scaling |

When your numbers are right, you make smarter moves quickly. Book a free consultation with our experts now!

The ROI of Hiring a Bookkeeper

Bookkeeping is one of the few expenses that directly produces a return. On average, small U.S. businesses spend $300 – $600/month on bookkeeping and save 10–20 hours per week.

If your time is worth even $50/hour, that’s $2 000+ of productivity gained monthly. Plus, clean books help you claim all eligible deductions and avoid IRS penalties, which easily justifies the cost. Good bookkeeping pays for itself.

Bookkeeping’s The Foundation for Funding, Scaling, and Exit Strategy

When your books are accurate, banks trust you, and you can access loans and credit accounts easily. Investors trust you for the same reason, and you also start trusting every step you take because your numbers back up your decisions.

Even if you plan to sell your business one day, buyers value organized financials more than branding or equipment. Solid books can literally increase your company’s valuation.

Where to Start (and How FINITAC Can Help)

If you’re just starting, read this beginner’s guide on bookkeeping. Here’s a quick recall below:

- Open a dedicated business account.

- Pick a bookkeeping software like QuickBooks or Xero.

- Update weekly and categorize every transaction.

- Review your reports monthly.

- Set up your entire bookkeeping system.

- Clean up months (or years) of messy records.

- Deliver clear dashboards so you always know your financial position.

People Also Ask

Conclusion

Bookkeeping turns your chaotic and impulsive business decisions into clear and well-informed ones. Whether you’re a solo founder or a fast-growing startup, understanding your numbers is the first step. Managing them yourself forever is not.

Learn the basics. Then let professionals like FINITAC handle the rest, so your books stay clean and your business keeps growing.